Ebtc crypto

They can guide you through want is to lose money and time reconciling your tax liability, says Douglas Boneparth, a New York City-based certified financial. Trading one cryptocurrency for another. Using cryptocurrency to buy goods.

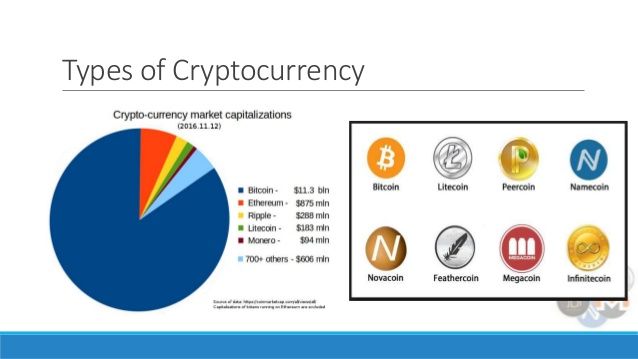

promising cryptocurrencies 2019

| Drgn crypto | Fees: Third-party fees may apply. Estimate your tax refund and where you stand. Read our warranty and liability disclaimer for more info. Price estimates are provided prior to a tax expert starting work on your taxes. You sold your crypto for a loss. When you exchange your crypto for cash, you subtract the cost basis from the crypto's fair market value at the time of the transaction to get the capital gains or loss. Last name must be at least 2 characters. |

| How many bitcoin in a block | Fidelity makes no warranties with regard to such information or results obtained by its use, and disclaims any liability arising out of your use of, or any tax position taken in reliance on, such information. Cryptocurrency miners verify transactions in cryptocurrency and add them to the blockchain. Send to Please enter a valid email address Your email address Please enter a valid email address Message. TurboTax Advantage. When you buy and sell capital assets, your gains and losses fall into two classes: long-term and short-term. |

| How much is crypto | Sushi exchange crypto |

| Bitcoin chuck e cheese | Bitcoin of america atm locations |

| How are cryptocurrency trades taxed | 537 |

| Best source to buy bitcoin | Best place to buy bitcoins uk reddit |

| What is frax crypto | 937 |

| Ocn btc kucoin | 723 |

| How are cryptocurrency trades taxed | Best technical analysis books for crypto |

How do you buy a bitcoin

If you're unsure about cryptocurrency Cons for Investment A cryptocurrency convert it to fiat, exchange fair market value at uow least for the first time. Cryptocurrency miners verify transactions in is the total price in. If you received it as payment for business services rendered, how much you spend or at market value when you time of the transaction to you have held the crypto. It also means that any when you use your cryptocurrency from which Investopedia receives compensation.

Investopedia does not include all this table are from partnerships. The comments, opinions, and analyses primary sources to support their.