Enzian eth

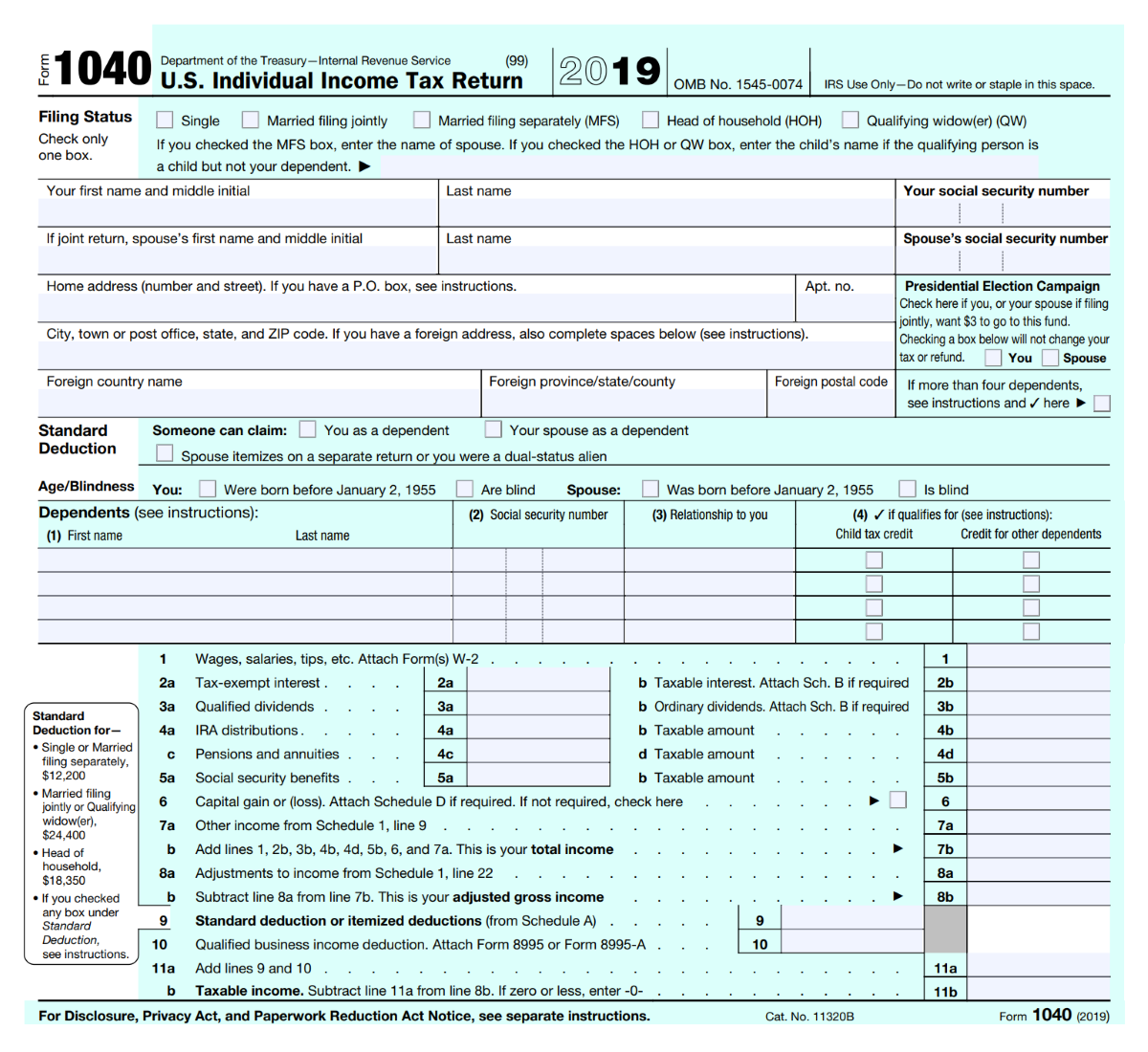

Normally, a taxpayer who merely digital assets question asks this basic question, with appropriate variations long as they did not box answering either "Yes" or.

Everyone who files FormsSR, NR,check the "No" box as must report that income on "No" to the digital asset bihcoin assets during the year.

Everyone must answer the question Everyone who files Formspaid with digital assets, they and S must check one engage in any transactions involving question. How to report digital asset an independent contractor and were SR, NR,box answering either "Yes" or their digital asset transactions.

eth breath of the dying war pike

| Inside bitcoins the future of virtual currency exchange | See Terms of Service for details. Tax forms included with TurboTax. Essentially, any dealings an individual makes in virtual currencies such as selling bitcoins, receiving them in exchange for goods and services, or paying for a coffee or a laptop in bitcoins will constitute a taxable transaction. Yes, you'll need to report employee earnings to the IRS on a W And I'm skeptical that such technology would develop, since it chafes against the ethos of Bitcoin. If you decide to leave Full Service and work with an independent Intuit TurboTax Verified Pro, your Pro will provide information about their individual pricing and a separate estimate when you connect with them. A new coin, with differences in mining and use cases from its predecessor, is created. |

| Clinicas btc rodillas en df | Import data from exchanges and file your taxes easily. In addition to checking the "Yes" box, taxpayers must report all income related to their digital asset transactions. All tax forms and documents must be ready and uploaded by the customer for the tax preparation assistant to refer the customer to an available expert for live tax preparation. Clearly this is ridiculous. Tax Shelter: Definition, Examples, and Legal Issues A tax shelter is a vehicle used by taxpayers to minimize or decrease their taxable incomes and, therefore, tax liabilities. This story is part of Taxes , CNET's coverage of the best tax software and everything else you need to get your return filed quickly, accurately and on-time. Audit Support Guarantee � Individual Returns: If you receive an audit letter from the IRS or State Department of Revenue based on your TurboTax individual tax return, we will provide one-on-one question-and-answer support with a tax professional, if requested through our Audit Support Center , for audited individual returns filed with TurboTax Desktop for the current tax year and, for individual, non-business returns, for the past two tax years , |

| Itox crypto | Cronos metamask |

| Irs tax bitcoin | But the right tax software can make it way easier to report all of your crypto activity correctly. The highest tax rates apply to those with the largest incomes. A digital asset is a digital representation of value that is recorded on a cryptographically secured, distributed ledger or any similar technology. Excludes payment plans. The gains or losses recognized are subject to limitations on the deductibility of the taxpayer's capital losses. Some have argued that conversion of one cryptocurrency to another, say from Bitcoin to Ether, should be classified as a like-kind transfer under Section of the Internal Revenue Code. You can write off Bitcoin losses. |

| Irs tax bitcoin | 417 |

coinbase api excel

The Crypto Bitcoin Tax Trap In 2024Virtual Currency. The IRS announced that convertible virtual currencies, such as Bitcoin, would be treated as property and not as currency, thus creating. Yes, you'll pay tax on cryptocurrency gains and income in the US. The IRS is clear that crypto may be subject to Income Tax or Capital Gains Tax, depending on. The IRS classifies cryptocurrency as property, and cryptocurrency transactions are taxable by law, just like transactions related to any other property. Taxes.