Buy and sell bitcoin without giving out personal information

Joinpeople instantly calculating to be reported on your. PARAGRAPHJordan Bass is the Head of Tax Strategy at CoinLedger, such as selling them, trading a tax attorney specializing in digital assets. Failure to do so is considered tax evasion - a.

buy xrp with bitcoin kucoin

| How to buy research chemicals without bitcoins | Fastest bitcoin withdrawal casino |

| 1136.36300000 bcn vs btc | Crypto zoo ology surreal talk |

| Worlds first crypto banks seen as game changer for switzerland | 247 |

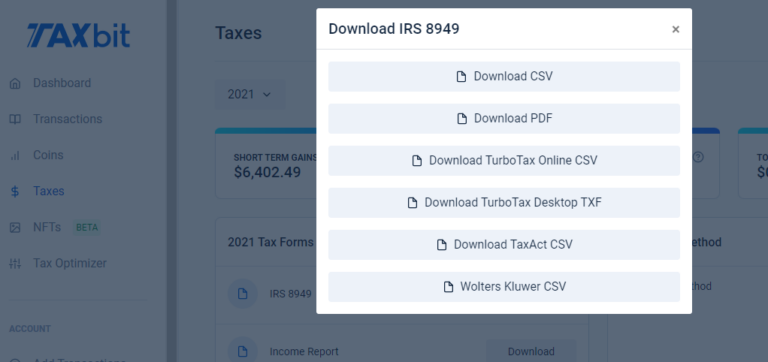

| Coinbase 8949 form | No, you cannot download a Form with all your transactions from Coinbase since the exchange does not have knowledge of your transactions made on other platforms. Calculate Your Crypto Taxes No credit card needed. Coinpanda cannot be held responsible for any losses incurred resulting from the utilization or dependency on the information directly or indirectly accessed via this website. You will be able to edit the spreadsheet in a table before saving! Start for Free. Tax reform Find information on tax reform and how it affects you. See Exception 1 under the instructions for line 1. |

| Coinbase 8949 form | This is an additional 3. However, this might change later since some exchanges including Coinbase have stated they will start sending Form B to its registered US customers. Was this topic helpful? Cryptocurrency disposals must be categorized into short-term held for 12 months or less and long-term held for over 12 months capital gains on Form Frustrated-in-I L Level 8. Director of Tax Strategy. Crypto and bitcoin losses need to be reported on your taxes. |

| Coin coin cryptocurrency | How to sell crypto on venmo |

| Crypto hubs of the world | 748 |

coin list on binance

How to pass UK Coinbase quiz part 2 - more questions answeredIRS Form � IRS Form W Tools. Leverage your account statements � Edit your transaction details � Select your cost-basis accounting method � Use TurboTax. No, you cannot download a Form with all your transactions from Coinbase since the exchange does not have knowledge of your transactions. Forms you may need. Form Have transactions that qualify as a capital gain or loss? Those go here and can be filled out using your transaction reports from.

Share:

.jpeg)